how to calculate time and a half pay rate

Here is the formula for calculating time and a half. Since straight-time earnings have already been calculated see Step 1 the additional amount to be calculated is one-half the regular rate of pay 10.

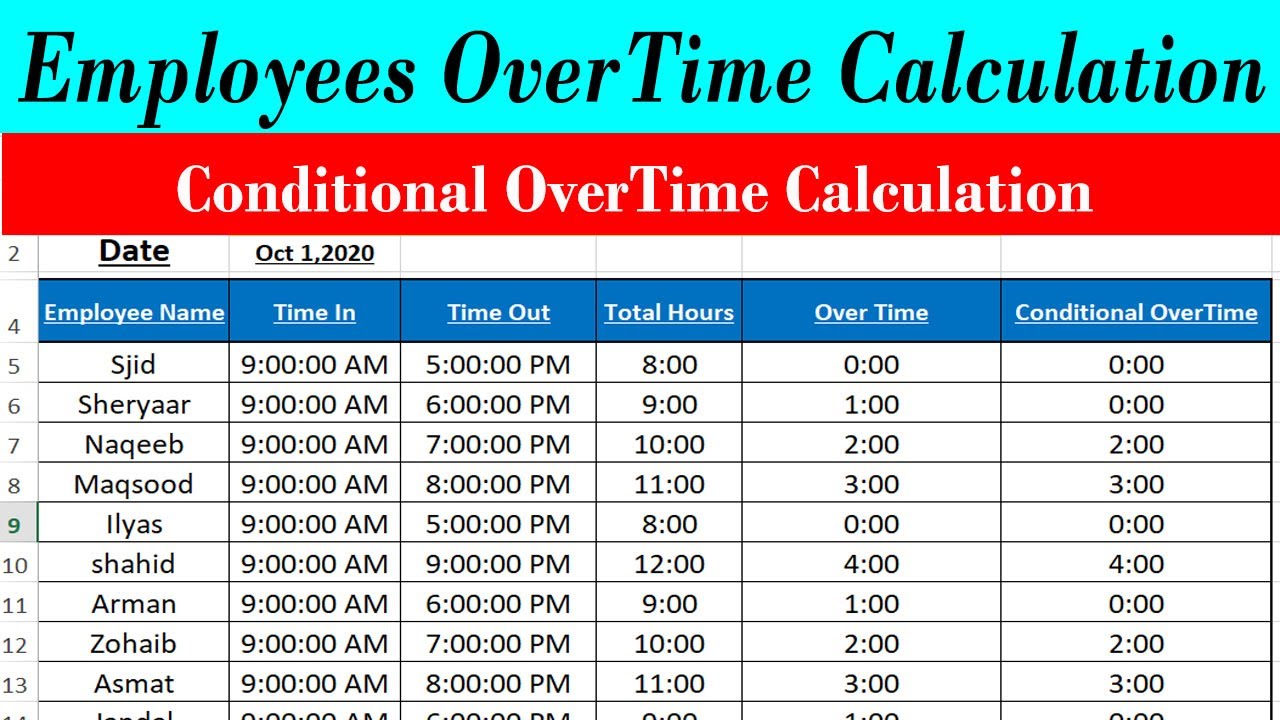

Excel Business Math 30 Payroll Time Sheets If Function Sheet Reference For Overtime Gross Pay Excel Payroll Math

Time and a half hourly.

. Using this calculation Bob will earn 2813 per extra hour totaling 14063 for such weeks. A common rule is that overtime pay must be 15 times the regular rate of paycommonly called time and a half So if your employee earns 20 an hour their overtime rate would be 30 per hour. OP n HOP.

Overtime pay is often more than the regular hourly rate too. This free online income calculator will calculate your overtime rate of pay based on your regular hourly rate multiplied by the ot multiplier that applies to your job time and a quarter time and a third time and a half double time triple time etc. Secondly use the formula mentioned above to calculate the time and a half rate.

Then multiply their pay rate by 15 time and a half. Calculate regular rate of pay. Next calculate the employees time and a half pay rate.

1600 300 1900. The overtime pay calculation is simple. To get the overtime pay rate you thus need to multiply the hourly.

Now multiply the overtime rate by the amount of overtime hours. Time and a half 30 15 45. Calculate overtime hourly pay rates given normal or standard pay rate.

Time and a half standard hourly rate x 15 This equation gives you the hourly rate of pay for non-exempt employees who work for more than 40 hours per week. 2625 10 26250 Therefore John earned an extra 26250 through his time and a half pay. Calculate the employees regular earnings.

To calculate what Mary earned for the overtime work she did her employer has to multiply the 20 hours by the time-and-a-half rate of 15. 500 straight-time pay divided by 50 hours worked 10 per hour. 90045 hours 20 per hour.

There is no limit in the Act on the number of hours employees aged. Multiply Johns standard pay of 1750 by 15 to find the time and a half rate 1750 15 2625 Multiply 2625 by the ten extra hours worked to find overtime wages due. Fair Labor Standards Act to pay time and a half wages regular hourly rate x 15.

Next identify how many overtime hours employees worked in a workweek. How do you calculate overtime pay. To find the employees regular earnings multiply their regular pay rate 12 by 40 hours.

This counts even if they have only worked part of a full hour. Unless exempt employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay. 2040 hours - 40 hours 5 paid vacation days off.

There workers who work 8 to 12 hours a day are paid a rate of one and a half. To calculate time and a half follow the steps given below. First calculate her hourly rate for this particular week.

HOP m HRP. Normal or standard pay rate hour unitless. For a given week track the amount of time your employee worked.

Another way some people calculate it which is the same in the end is this. Where HOP Hourly overtime payment. Now multiply the amount of given overtime hours by.

Time and a half equates to 50 more than an employees regular hourly pay rate. You should have an exact figure of your hourly overtime to find total overtime precisely. From there you calculate the time and a half rate the same as an hourly employee.

Lets calculate his time and a half pay. Calculate the overtime wages by time and a half 15. There is a notable exception however.

Calculates time and a half double triple and quadruple overtime pay rates. In most cases overtime pay is 15 times the employees normal pay known as time and a half. To calculate the employees total wages for that pay period add together the employees standard wages for a two-week pay period double the weekly.

Find out how many hours they worked over 40. For non-exempt hourly employees who work more than 38 hours a week you can calculate time and half as follows. For example lets say a salaried employee who earns 52000 per year makes 1000 per week 52000 52 weeks.

20 hours x 15 300. Find the time and a half rate by multiplying the standard hourly rate by 15. Marys gross salary for October.

750 x 5 hours overtime pay at half rate to create time and one-half 3750 overtime pay 71250 total pay owed. Regular pay of 15 8 hours 120. Multiply the time and a half rate by the number of overtime hours the employee worked to find the overtime wages due.

A method for determining and calculating the employers hourly rate and understand that the choice can. M multiplier usually 15 HRP Hourly regular payment. In Melindas example the 5 overtime hours have been paid at the standard rate with her weekly pay.

Next calculate the employees time and a half pay rate. Multiply the overtime rate from above 18 by the number of overtime hours the employee worked during the week. How to Calculate Overtime Pay.

If you need to calculate the hourly overtime pay then you need to multiple hourly regular pays with a multiplier as. 15 x 40 base hours 600 for regular pay for the first 40 hours 2250 x 5 overtime hours time and one-half 11250 71250 total pay. Multiply 15 by the employees regular rate of pay.

Calculating time and a half for hourly employees. And the number of hours exceeding the 12-hour limit is doubled. Time-And-A-Half or Double Time Overtime Rates.

Here are the steps for calculating overtime for different types of employees. Finally multiply this time-and-a-half pay rate by the number of overtime hours they worked. Overtime payments are commonly called the overtime premium or the overtime rate of payThe most usual rate for overtime hours is time and a half and that is 50 more than employees standard wageIt means that for every hour of overtime you receive an equivalent of 15 the regular hourly rateSo if you want to repair your personal budget do some overtime work.

Marys employer adds the 300 overtime pay to her regular monthly salary of 1600 which equals 1900. Their overtime rate is 15 times their regular hourly rate. Hourly workers appreciate leaving work on time allowing them to do other important activities.

First of all note down the regular hourly wage. 10 regular rate of pay x 5 x 10 overtime hours 50. Likewise rendering extra hours effectively increases their annual income.

Their time of work is tracked and they receive compensation for the excess hours. During the weeks when he works 45 hours a week he will earn time-and-a-half pay or 1875 X 15 for the extra five hours he works. Normal or standard pay rate ----overtime - time and a half 15 ----.

This free online income calculator will calculate your overtime rate of pay based on your regular hourly rate multiplied by the OT multiplier that applies to your job time and a quarter time and a third time and a half double time triple time etc. The federal overtime provisions are contained in the Fair Labor Standards Act FLSA.

What Is Time And A Half How To Calculate Time And A Half Half Legal Advice Payroll Software

Hourly Pay Overtime Pay Task Cards Task Cards Task Cards

Excel Formula To Calculate Hours Worked And Overtime With Template Excel Formula Microsoft Excel Formulas Excel

What Is Annual Income How To Calculate Your Salary Income Income Tax Return Salary Calculator

Pin On Fitness Health Calculators

Overtime Calculator To Calculate Time And A Half Rate And More Conversion Calculator Mortgage Payment Calculator Loan Calculator

Get Our Example Of Employee Compensation Plan Template For Free Compensation How To Plan Online Business Plan Template

Organizes Your Working Day By Checking In And Out Your Hours Calculating Your Wages And More Windows Xp Vista 7 8x 10 Software Calculator Day And Time

Working In Qatar How To Calculate Your Overtime Pay 2021overtime Calculation Formula In Qatar Changing Jobs Formula Qatar

Overtime Pay Laws Every Business Owner Needs To Know Business Entrepreneurship Business Management Business Basics

Employees Daily And Monthly Salary Calculation With Overtime In Excel By Learning Centers Excel Tutorials Salary

Overtime Calculator To Calculate Time And A Half Rate And More Money Lessons Online Calculator Family Money

Pin By Sukoon Tashkeel On Quick Saves In 2022 Measuring Success Teaching Best Scale

Overtime Calculator To Calculate Time And A Half Rate And More Money Lessons Online Calculator Family Money

Digital Heart Rate Calculator For Running Racing Training Calculate Hr Zones Google Spreadsheet Or Microsoft Excel Download Google Spreadsheet Microsoft Excel Spreadsheet

Excel Formula For Overtime And Conditional Overtime Calculation In E Excel Formula Learning Centers Excel Tutorials

Heart Rate Calculator For Running Racing Training Etsy Google Spreadsheet Spreadsheet Interactive

Secured Credit Card Creditcard Have You Ever Talked To Anybody About Your Dream Of Getting Out Of Debt Did They Debt Payoff Credit Card Debt Payoff Debt Free

0 Response to "how to calculate time and a half pay rate"

Post a Comment